Rising expenses and evolving urban lifestyles are reshaping car ownership accessibility for many.

Car ownership, once considered a standard milestone, is increasingly slipping beyond the financial reach of many households. Factors such as rising fuel costs, expensive maintenance, climbing insurance premiums, and higher interest rates contribute to this shift. Additionally, urbanization and improvements in public transit reduce the practical need for personal vehicles. Understanding these challenges is essential for anyone evaluating the true cost and feasibility of owning a car today.

1. Rising fuel prices steadily increase the overall cost of car ownership.

Fuel prices have seen a steady climb, making car ownership increasingly costly. When prices at the pump rise, the ripple effect touches every driver’s wallet, especially those who rely on their vehicles for daily commutes or long-distance travel.

Meanwhile, fluctuating fuel markets make budgeting unpredictable, adding financial stress to car owners. Coupled with other soaring expenses, these price increases challenge the assumption that maintaining a vehicle will remain affordable. Understanding these dynamics underscores the necessity of planning for every journey, not just the destination.

2. Maintenance and repair expenses grow as vehicles become more technologically complex.

Modern vehicles incorporate advanced technology, which complicates maintenance and repair processes. Components like sensors and software systems require specialized skills, leading to higher service fees at the garage. It’s the intricate dance of technology and machinery.

As these complexities grow, so too does the likelihood of unexpected mechanical failures that may not be covered under standard warranties. Owners face the inconvenience of potentially longer wait times and additional labor costs in keeping their cars on the road. Complexity, in this context, promises neither economy nor simplicity.

3. Insurance premiums continue to climb, reflecting higher risk assessments and claims.

Insurance premiums steadily increase due to higher risk assessments and more frequent claims. Insurers calculate premiums by weighing factors such as accident statistics and repair costs, influencing the annual cost of keeping a vehicle insured.

These rising premiums further strain the budget of car owners, especially for those already grappling with other vehicle-related expenses. Adjusting policy coverage levels becomes a careful balancing act between adequate protection and affordability, with many consumers feeling pressured by limited choices.

4. Urbanization encourages alternative transportation, reducing the practical need for cars.

As urban spaces expand, alternative transportation modes become preferable for many. Congested city streets coupled with improved public transit systems render traditional car ownership less pragmatic within metropolitan areas.

Residential areas are seeing a shift where shared mobility services gain popularity, diminishing the desire for personal vehicles. This trend highlights an evolving culture where the car is no longer the centerpiece of urban life but rather an option among many for navigating bustling cityscapes.

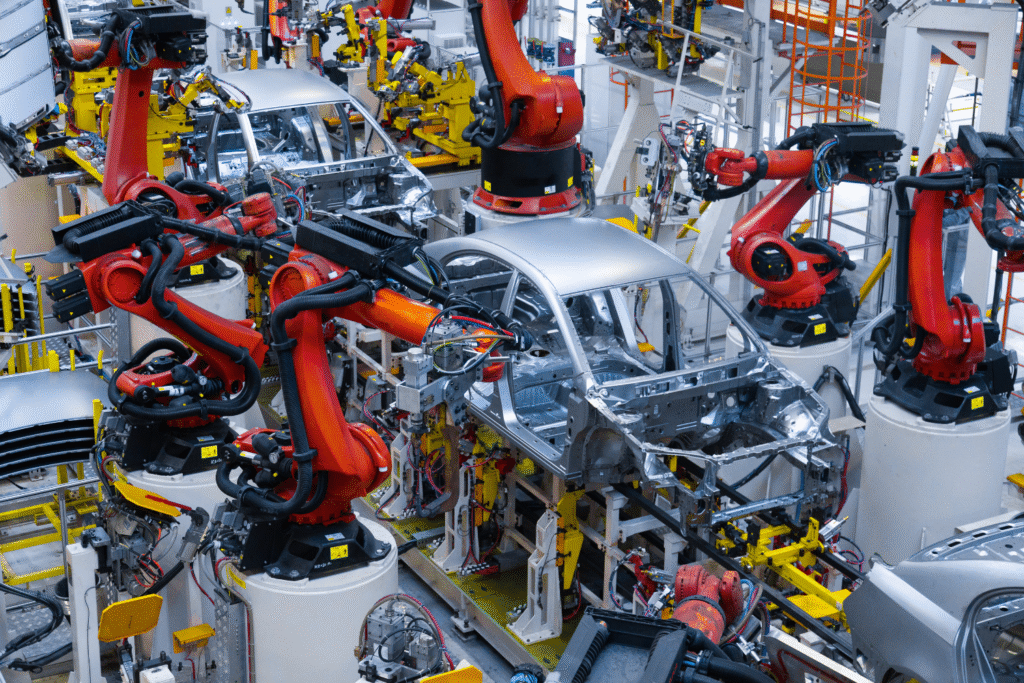

5. Environmental regulations add costs to manufacturing and maintaining fuel-efficient vehicles.

Implementing strict environmental regulations on vehicles incurs significant costs for manufacturers and consumers. Automakers face increased production expenses to meet emission standards, often passing these costs to buyers who seek fuel-efficient models.

As eco-friendly compliance drives innovation, some consumers feel the financial pinch of market-adjusted pricing and necessary upgrades. Balancing sustainability with affordability requires industry-wide innovation, pushing forward trends that might eventually become the norm in everyday vehicular choices.

6. Limited parking availability drives up the indirect expenses of owning a car.

Parking infrastructure limitations contribute to the hidden costs of owning a car. In crowded urban areas, the scarcity of parking spaces can result in added expenses for leasing or reserving spots, particularly in high-demand districts.

These costs quietly accumulate, making city driving less economically feasible for some. Car owners often face a trade-off between convenience and expenditure, translating spatial constraints into genuine financial considerations that impact broader lifestyle choices.

7. Depreciation rates impact vehicle resale value, affecting long-term affordability.

The depreciation rate of vehicles directly affects their resale value, impacting long-term affordability. Cars lose value over time due to wear and tear, driving conditions, and market demand, which influences potential returns upon resale.

For those financing their vehicles, depreciation reduces equity more rapidly than loan balances decrease. These values emphasize the importance of understanding depreciation’s delineation on overall ownership costs and highlight both immediate and delayed financial repercussions.

8. Increasing interest rates raise monthly payments on car loans and leases.

Rising interest rates increase the cost of monthly payments on car loans and leases. When financial institutions adjust their rates, the impact directly influences the affordability of financing options for prospective buyers.

Higher rates extend the time it takes to pay off loans, possibly elevating total out-of-pocket costs throughout the loan term. Those impacted by these shifts face adjusting personal budgets to accommodate steeper, sustained payments until economic conditions stabilize.

9. Public transit improvements offer cheaper, more convenient travel options in many cities.

In many cities, improvements in public transportation deliver affordable and flexible travel alternatives. Modernized fleets, enhanced routes, and convenient scheduling create reliable options for daily commuters seeking cost savings and reduced stress.

As public transit systems evolve, some individuals re-evaluate their reliance on personal vehicles, seeing an economical opportunity to opt into shared mobility. This change connects in-city travel with broader discussions about accessibility and practicality, reshaping urban landscapes.

10. Shifts toward remote work reduce daily commuting, lessening reliance on personal vehicles.

Remote work’s rise shifts daily commuting patterns, diminishing reliance on personal vehicles for many. As more people work from home, the necessity of a daily drive dissipates, altering the traditional nine-to-five routine.

Fewer trips result in decreased wear and tear on personal cars, potentially extending vehicles’ lifespan. This shift reframes the modern work-life balance and challenges preconceived notions about consistent car usage in professional contexts—a reflection of evolving employment standards.

11. The complexity of electric vehicles demands specialized service, often at higher costs.

Electric vehicles (EVs) introduce complexity requiring specialized knowledge for service and repair. The unique architecture of electric powertrains demands skilled technicians and distinct maintenance protocols, often leading to higher service costs.

This specialization can scarce resources in certain areas, increasing waiting periods for EV owners needing critical repairs. While advantageous in emissions reduction, the infrastructure to support such vehicles adapts slowly, posing challenges to effective ownership strategies without deliberate planning.

12. Growing car-sharing services provide cost-effective alternatives to traditional ownership.

Expanding car-sharing services offer financially accessible alternatives to conventional car ownership. These programs allow users to rent vehicles on-demand, bypassing many associated costs like insurance and maintenance.

For suburban dwellers or urbanites seeking flexibility, car-sharing represents an adaptable solution aligning with modern mobility needs. Whether for occasional errands or spontaneous trips, these services embody a customized approach to transportation that suits varied populations without long-term commitments.