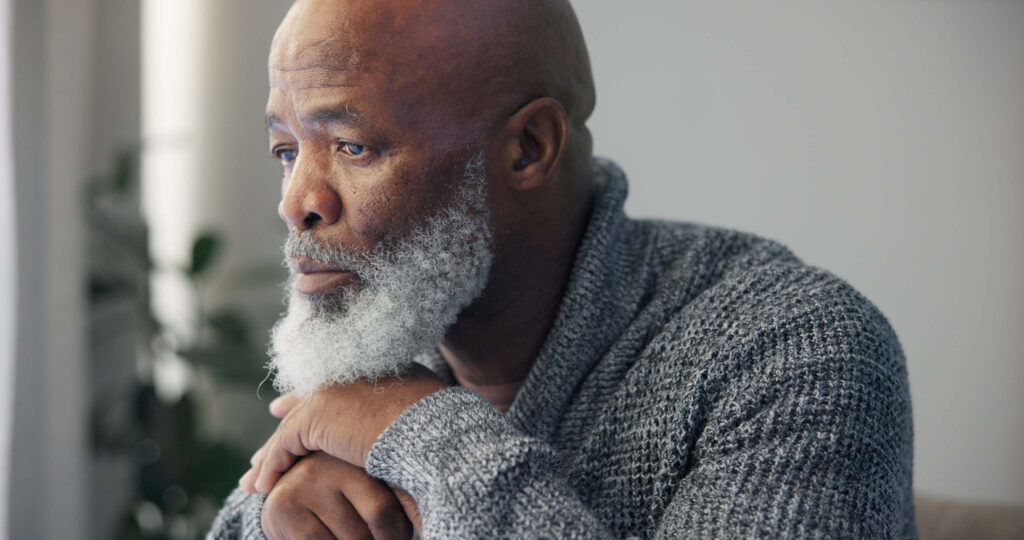

Many older Americans dread running out of money more than facing the end.

A recent Allianz study finds that about two-thirds of Americans fear depleting their retirement savings more than they fear death itself. This unsettling insight underscores a dramatic shift in what feels threatening to us.

Financial anxiety now looms larger than mortality in many minds. Between rising living costs, uncertainty about social supports, and the possibility of extraordinarily long retirements, what should be a restful chapter risks becoming a source of constant stress and uprooted peace.

1. The fear of outliving savings is widespread.

Studies highlight that Americans across income levels worry about their money running out before life does. It’s not only the lower or middle class—wealthier individuals also fear longevity outpacing savings. The psychological weight of not knowing how long money needs to last creates ongoing anxiety.

That uncertainty fuels stress about retirement planning. People can estimate expenses, but no one can predict how long they’ll live or what unexpected costs may arise. This unknown factor makes outliving savings one of the most unsettling financial risks, as mentioned in CBS News.

2. Longevity is reshaping retirement expectations.

Medical advances mean people are living longer, but longer lives come with higher costs. Each extra year adds another layer of spending on healthcare, housing, and daily living. Instead of celebrating longer life spans, many people view them as financial challenges to endure.

This shift has altered retirement planning. Instead of planning for a decade or two of retirement, people must prepare for 30 years or more. That extended timeline makes financial security harder to achieve, amplifying fears about money evaporating too soon, according to Yahoo! Finance.

3. Healthcare costs are a looming shadow.

Healthcare remains one of the most unpredictable expenses in retirement. Even with Medicare, out-of-pocket costs for prescriptions, hospital stays, or long-term care can be staggering. People worry that one serious illness could wipe out years of careful saving in an instant.

These concerns aren’t exaggerated. Studies consistently show that medical expenses consume a large share of retirement budgets. The fear of financial ruin due to health issues reinforces why so many rank money worries above death itself, as stated in Kiplinger.

4. Inflation adds to financial anxiety.

Retirement plans made a decade ago may not hold up under today’s rising costs. Inflation quietly erodes the value of savings, making essentials like groceries, utilities, and rent harder to afford on fixed incomes. Even modest price increases add up quickly when stretched across decades.

This reality leaves retirees feeling powerless. They can cut back, but they can’t control the broader economy. Watching savings lose purchasing power year after year only intensifies the fear of running dry too soon.

5. Trust in safety nets is shaky.

Social Security and pension programs were once considered reliable, but many now doubt their long-term stability. Reports about possible funding shortfalls or political debates create constant unease. Retirees and future retirees alike feel they can’t fully rely on these systems to protect them.

This erosion of trust adds another layer of uncertainty. People worry that benefits may shrink or disappear just when they’re needed most. That lack of confidence pushes fears of financial collapse ahead of even existential worries.

6. Lifestyle expectations complicate planning.

Retirement isn’t just about survival—it’s also about quality of life. People fear that limited funds will strip them of dignity, independence, and joy. The thought of being forced to give up travel, hobbies, or even comfortable living conditions is devastating for many.

This fear isn’t always about luxury. For some, it’s the simple hope of maintaining familiar routines. Losing that sense of normalcy due to money shortages adds emotional weight to already heavy financial concerns.

7. Debt follows many into retirement.

Older adults increasingly carry mortgages, credit card balances, or medical debt well into their retirement years. Instead of enjoying financial freedom, they’re juggling payments on fixed incomes. Debt eats into savings faster than expected, shrinking the cushion people depend on.

These obligations leave retirees vulnerable. Unexpected expenses can push them over the edge, and paying interest feels like throwing money away. Carrying debt into later life intensifies the dread of running out of money.

8. The cultural stigma of dependence is strong.

Many Americans fear becoming a financial burden on children or relatives. The idea of relying on others for basic needs feels humiliating, especially in a culture that prizes independence. This dread magnifies the importance of maintaining enough savings to cover personal expenses.

That fear often outweighs even health concerns. People would rather face mortality than the shame of dependency. It’s a deeply emotional element of financial insecurity, showing how intertwined money is with identity and dignity.

9. The financial industry fuels the fear.

Retirement planning ads often emphasize the risks of outliving savings, playing directly into consumer anxieties. While this can motivate better planning, it also amplifies fears. People see retirement less as a time of relaxation and more as a financial minefield to navigate.

This constant messaging shapes public perception. Even those who may have adequate savings begin to second-guess their security. The industry thrives on keeping fear alive, but the psychological cost for retirees is immense.

10. Women face a disproportionate risk.

Women often live longer than men but earn less over their lifetimes, leaving them with smaller savings. Career breaks for caregiving also reduce retirement contributions. This double burden means many women are especially fearful of outliving their resources.

The concern isn’t just financial—it’s emotional. Knowing they may spend more years alone increases the urgency of having secure finances. For many women, the prospect of financial scarcity feels like a heavier threat than death itself.

11. Retirement planning requires tough trade-offs.

Preparing for decades of retirement often means sacrificing in the present. People put off vacations, hobbies, or even home repairs to save more aggressively. These compromises create a constant tension between living well now and securing the future.

That balancing act never feels perfect. Saving enough still doesn’t guarantee certainty, and the sacrifices can feel endless. This ongoing struggle feeds into why the fear of financial failure in retirement overshadows mortality itself.

12. Financial literacy gaps add to insecurity.

Many people feel overwhelmed by the complexity of investing, taxes, and planning for retirement. Without clear knowledge, they fear making mistakes that could cost them comfort later in life. This lack of confidence magnifies their worries about running out of money.

Education helps, but access isn’t universal. Not everyone has the resources to hire financial planners or take classes. The knowledge gap leaves many people vulnerable to anxiety, even if their financial situation is relatively stable.

13. Redefining what security means is crucial.

At its core, the fear of going broke in retirement reflects deeper questions about control, dignity, and peace of mind. People want assurance that their final decades will be safe and comfortable, without financial chaos overshadowing them.

This shift requires more than just savings. It demands redefining what true security looks like—balancing money with community, health, and resilience. Only then can the fear of financial ruin begin to ease, even in the shadow of mortality.