These tough lessons will change the way you handle hard times and make the most of what you have.

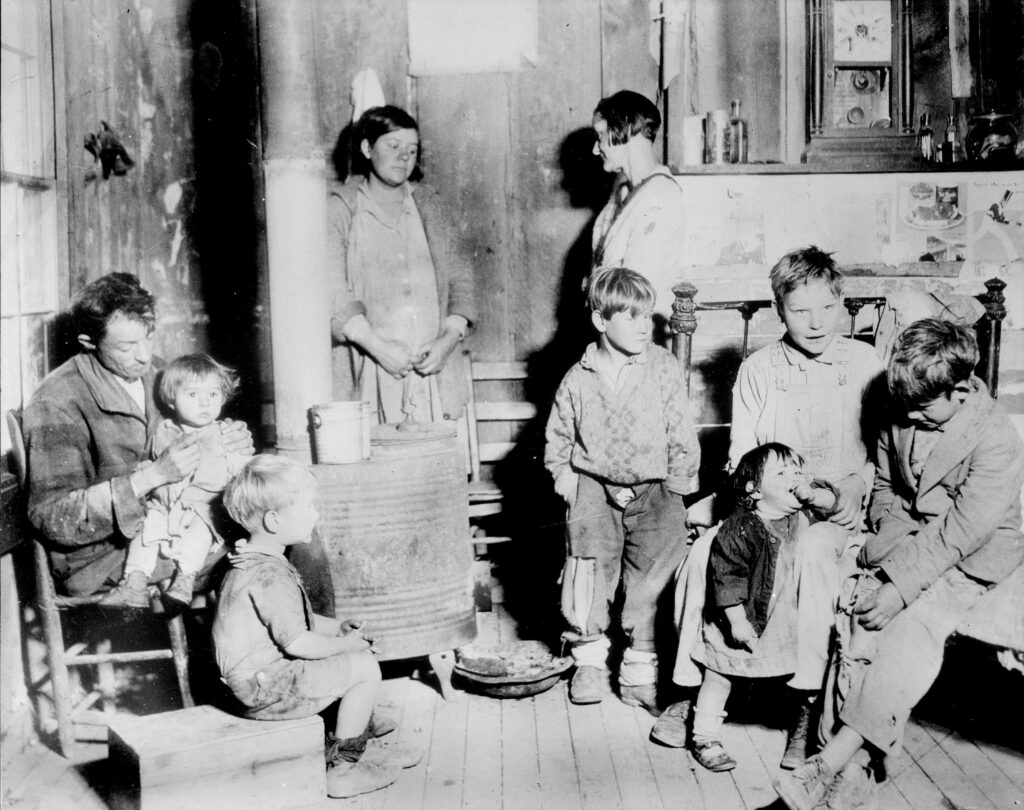

Ok millennials, you’re probably wasting money and making life harder than it needs to be. The people who lived through the hardest economic periods—like the Great Depression or post-war eras—learned how to stretch every dollar with grit, creativity, and discipline. They didn’t have the luxury of convenience, and yet they got by with far fewer resources and still managed to build lives full of meaning and resilience.

Their wisdom goes beyond quaint nostalgia. These aren’t just “grandma’s tips”—they’re battle-tested survival strategies that can radically change your relationship with money, time, and happiness. If you’ve ever felt overwhelmed by bills, unprepared for the unexpected, or tired of the endless cycle of spending, these hard-earned lessons are your wake-up call.

1. You’re Throwing Away Money by Not Reusing Everything

Our grandparents and great-grandparents lived in a world where waste wasn’t just frowned upon—it was practically unheard of. If something could be repaired, mended, or reused in another way, that’s exactly what happened, as stated by Terri at Terrific Words. Socks were darned, shirts were patched, jars became storage containers, and old newspapers lined drawers or cleaned windows. This frugality wasn’t stinginess—it was resourcefulness born of necessity.

Today, the ease of ordering a replacement on your phone means we lose sight of how much we’re discarding—and how much it’s costing us. By shifting your mindset to see value in used items, you tap into a kind of quiet abundance. Whether it’s saving wrapping paper, repurposing food scraps, or turning old clothes into cleaning rags, small decisions add up. Reusing things not only saves money, it also strengthens a mindset that values what you already have.

2. If You Don’t Know How to Cook Cheap, You’re in Trouble

There was a time when a sack of potatoes, a few eggs, and some canned goods could feed a family for a week—and no one complained. People knew how to make stews stretch, bread last, and nothing went to waste. Cooking from scratch wasn’t a trendy skill; it was a survival necessity, said Lisa Bedford at The Survival Mom. And the meals? They were often more nutritious and satisfying than what we get from fast food or takeout.

These days, the convenience of dining out or ordering in is a major budget killer. If you’re serious about getting your finances under control, mastering a handful of cheap, filling recipes is non-negotiable. Learn to batch cook, freeze leftovers, and build meals from pantry staples. Not only will you save a lot of money, but you’ll gain confidence in the kitchen and appreciate the quiet satisfaction that comes with making something nourishing from almost nothing.

3. Your Skills Matter More Than Your Stuff

When times got tough, people didn’t turn to Amazon or rely on subscription services to solve their problems. They rolled up their sleeves and figured it out. They grew their own food, made their own clothes, fixed their own plumbing, and mended what broke. Having a useful set of skills was like having a toolbox of resilience that no economic downturn could take away, as shared by Elizabeth I. Hernandez at EPCC.

In today’s world, where consumerism often replaces competence, we’ve lost that mindset. But if you can learn to fix your bike, hem your jeans, build a raised garden bed, or even change your car’s oil, you reduce your dependence on spending and increase your confidence. Building skills is like investing in your future self—you become more self-reliant, less anxious about the unknown, and more equipped to handle whatever life throws your way.

4. If You’re Living Without a Budget, You’re Flying Blind

Living through economic hardship meant tracking every penny—literally. People knew exactly what they could spend and what had to wait. They didn’t spend on impulse because the consequences were immediate and severe. Budgets weren’t optional—they were survival tools that helped families avoid financial disaster and stretch every paycheck.

Fast-forward to today, and many people live paycheck to paycheck without ever knowing where their money actually goes. Budgeting doesn’t mean deprivation; it’s the opposite. When you know where your money is going, you feel empowered to make changes. You gain control over your spending habits and can spot the leaks before they sink you. Just tracking your spending for a week can open your eyes to waste you didn’t even realize was happening.

5. Debt Is a Trap That Can Ruin Your Future

For generations who didn’t have easy access to credit, debt was avoided at all costs. People saved up for what they needed or simply did without. They understood that debt was more than a monthly bill—it was a burden that weighed you down and limited your future choices. Even if it meant discomfort in the short term, living within their means was non-negotiable.

Today, with credit cards and buy-now-pay-later apps, debt is dangerously normalized. But it’s still a trap. It adds stress, limits freedom, and keeps you working harder just to stay afloat. If you’re already in debt, treat it like an emergency. Make a plan, cut expenses, and chip away at it. Every dollar you free from debt is a dollar you can use to build a more secure and independent life.

6. You’re Probably Wasting More Food Than You Realize

Wasting food was unheard of when resources were scarce and refrigerators were tiny. People planned meals around what they had, reused leftovers creatively, and turned even scraps into soups or casseroles. A pot of beans could stretch over days, and bones were boiled to make broth that nourished entire families.

Contrast that with today’s overflowing garbage bins filled with untouched takeout, spoiled groceries, and expired pantry items. The average household throws away hundreds of dollars in food every year. To break that cycle, start with better meal planning. Shop with a list, store things properly, and get creative with what’s already in your fridge. Not only will you save serious money, but you’ll become more mindful and intentional in your daily life.

7. Living Small Can Make You Happier Than Chasing More

Back then, homes were smaller, wardrobes were simpler, and luxuries were rare. But that didn’t stop people from enjoying their lives. In fact, less clutter often meant less stress and more appreciation for the things they did have. They didn’t measure happiness by material success but by meaningful relationships, simple pleasures, and peace of mind.

In our current culture, where bigger and newer seem to equal better, we often overlook how much our pursuit of “more” is robbing us of contentment. Downsizing your home, decluttering your space, or saying no to unnecessary upgrades can feel like a breath of fresh air. Living simply forces you to focus on what truly matters—and it turns out, that’s where real happiness lives.

8. You Don’t Need a Gym Membership to Stay Active

Daily life used to be a workout all on its own. People walked more, did chores by hand, and didn’t have desk jobs keeping them sedentary. Physical activity wasn’t scheduled; it was embedded in daily routines, from hanging laundry to digging in the garden or scrubbing floors.

Now we pay for fitness classes and memberships we barely use, even though staying active can be completely free. Walk instead of drive when you can. Stretch and move your body in the morning. Use your own bodyweight for resistance exercises. Activity is about consistency and lifestyle, not gym fees or fancy equipment. You’ll feel better, live longer, and save money all at once.

9. Community Support Is More Valuable Than Money

In lean times, people leaned on each other. They traded services, shared meals, offered rides, and watched each other’s kids. No one had much, but everyone shared what they could. This network of mutual support helped families survive when money wasn’t enough.

Today, it’s easy to feel isolated, even in a crowded city. But rebuilding that sense of community can transform your life. Invest time in relationships with neighbors, family, or local groups. Offer help when you can and don’t be afraid to ask for it in return. Emotional and practical support can be a lifeline during hard times, and those connections can become your greatest asset.

10. Fixing Things Is Almost Always Cheaper Than Replacing Them

People who lived through tough economic eras didn’t toss out a broken chair or appliance—they learned to fix it. Tools, basic know-how, and a can-do attitude went a long way in keeping household costs down. Whether it was gluing a cracked mug or sewing a ripped seam, repair was the first response—not replacement.

We’ve become quick to discard at the first sign of wear, often because it’s easier or because we’ve lost the know-how. But repair is a valuable skill and a major money-saver. Thanks to online tutorials, you can learn to fix almost anything from your smartphone. Start small and build your confidence. Every item you keep out of the landfill and out of your shopping cart puts money back in your pocket.

11. If You Can’t Find Joy in the Simple Things, You’ll Always Feel Poor

Our ancestors found happiness in a slower, simpler life. They laughed over home-cooked meals, took pride in handmade gifts, and found comfort in routines and rituals that didn’t cost a dime. Their sense of wealth came from connection and contentment, not consumerism.

If you’re constantly seeking happiness in new purchases, luxury experiences, or digital distractions, you’re chasing something that’s always just out of reach. Slow down. Take a walk. Make something with your hands. Call someone you love. The richest lives are built on simple joys—not bank balances.