Boomers’ estate plans increasingly focus on personal needs over leaving inheritances to Gen Z.

Many members of Gen Z anticipate inheriting wealth from their Baby Boomer parents as a financial safety net. However, economic challenges, longer retirements, and shifting priorities often lead Boomers to reconsider their estate plans. Rather than leaving substantial inheritances, Boomers may prioritize their own healthcare, lifestyle, and financial security, meaning Gen Z’s expectations may not align with their parents’ realities. Understanding these dynamics helps families navigate financial conversations with clarity.

1. Many Gen Z individuals expect inheritances despite changing family dynamics.

Gen Z faces evolving family dynamics that shape their expectations around inheritance. Amidst a backdrop of student loans and climbing housing costs, many anticipate financial relief from their Baby Boomer parents. Some see it as a future anchor, while others consider it a welcome windfall.

However, the likelihood of receiving generous inheritances is changing. Factors such as economic downturns, fluctuating stock markets, and the rising cost of living in retirement play roles in altering these expectations. Unlike in previous generations, financial cushions may no longer be reliable safety nets.

2. Boomer parents often reassess estate plans to prioritize their own needs.

Boomer parents often revisit their estate plans with an eye on current financial needs. With longer lifespans and uncertainties in healthcare costs, many choose to preserve resources for their own futures. Original plans might change as unexpected expenses arise over time.

Estate planning now includes careful consideration of personal lifestyle choices and future financial stability. Some Boomers opt to prioritize their long-term well-being rather than leaving a monetary legacy. This shift can lead to realistic adjustments in what heirs might expect.

3. Conversations about inheritance remain delicate and often avoided within families.

Discussing inheritance within families can be as delicate as handling fine porcelain. These conversations are often avoided due to their emotional and financial sensitivity. Misunderstandings or assumptions can lead to unspoken tensions that last over years.

Open discussions, although challenging, can ease these tensions and prevent future conflicts. A well-planned financial conversation allows for clarity around intentions and expectations, creating a shared understanding that aligns with family values and individual goals.

4. Economic uncertainties influence how Boomers choose to distribute their assets.

Economic uncertainties weigh heavily in decisions about distributing assets. Boomers, remembering past financial crises, may feel compelled to hold onto savings for potential future needs. The volatile nature of investment markets can make asset management both complex and unpredictable.

Some Boomers focus on preserving wealth through strategic decisions, influenced by fluctuating market conditions and changing tax regulations. These realities lead to tailored estate plans, emphasizing economic caution and security over traditional wealth distribution.

5. Gen Z’s financial outlook includes hopes tied to potential inheritances.

For Gen Z, the future financial picture often includes hopeful inheritances. While facing higher education costs and challenging job markets, they sometimes view this potential wealth as a stepping stone. It’s seen as a means to financial stability or as a tool for achieving personal goals.

Yet, an overreliance on these expectations can hinder immediate financial planning and independence. Realistic budgeting and goal-setting might be clouded by speculative financial safety that may not materialize as predicted.

6. Boomers show a growing interest in living benefits over posthumous gifts.

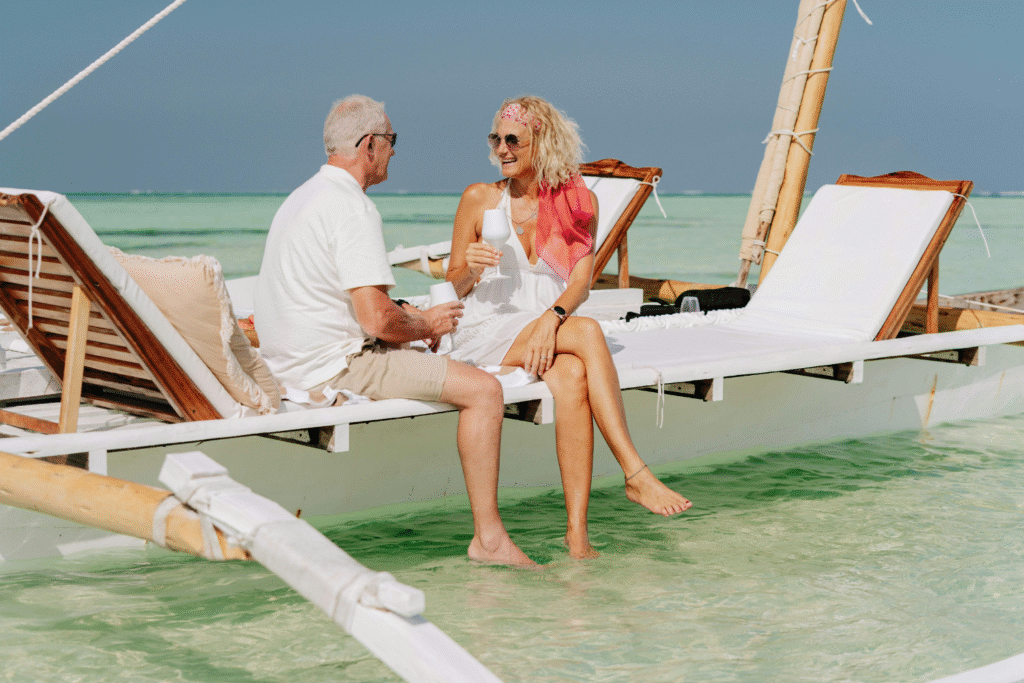

Boomers increasingly explore the benefits of enjoying wealth during their lifetimes instead of beyond. Travel, new hobbies, or family experiences become priorities, transforming traditional inheritance views. They lean toward spending on personal happiness and creating memories with loved ones now.

Living benefits, like enjoying travel or funding education for grandchildren, offer immediate satisfaction. These choices reflect a shift from preserving assets purely as future gifts to balancing personal enjoyment with family support.

7. Intergenerational wealth transfer patterns are shifting due to longer lifespans.

Longer lifespans impact patterns of wealth transfer between generations. Today’s retirees live healthier and more active lives, often extending far beyond previous generations. This requires more financial resources for longer durations, affecting the amount that might be left behind.

Increased lifespans mean decisions about asset distribution shift over time, with many choosing security in their later years over passing down large estates. For heirs, this translates into adjusted expectations surrounding inheritance timing and magnitude.

8. Some Boomers plan to gift money gradually rather than a lump sum later.

Some Boomers embrace the idea of gradually gifting money, shifting away from leaving a lump sum upon death. Incremental giving allows them to support family needs currently, offering immediate financial assistance for education or home purchases.

This approach fosters closer intergenerational bonds and provides clarity through structured allocation. By giving smaller amounts over time, both givers and receivers gain greater financial control and flexibility, spreading benefits across the family life cycle.

9. Gen Z tends to balance inheritance hopes with a desire for financial independence.

Balancing inheritance hopes with financial independence represents a pivotal relationship for Gen Z. While potential financial boosts are welcomed, establishing autonomy remains a primary goal. Career progress and personal savings take center stage, aligning with their aspirations for independence.

The desire for self-sufficiency often tempers reliance on future inheritances, encouraging prudent financial management. For many, achieving career milestones offers not just financial rewards but also a sense of accomplishment and empowerment, independent of anticipated family support.

10. Family values and communication styles heavily impact inheritance expectations.

Inheritance expectations hinge on family values and communication style within each household. Diverse attitudes toward wealth, legacy, and privacy lead to varying approaches to family finance discussions. Open dialogues typically make for clearer expectations and softer landing points.

Families that embrace transparent conversations about money often find mutual understanding. This aids in managing expectations effectively, aligning inheritance plans with shared familial objectives, and minimizing potential conflicts over financial and personal priorities.

11. Boomers may prioritize healthcare and retirement funding over legacy planning.

Healthcare spending and retirement funding emerge as primary concerns for many Boomers. Age-related expenses take precedence over traditional wealth transference. Ensuring access to quality care and a comfortable retirement often rivals the goal of passing on substantial inheritances.

These priorities reflect a shift toward securing personal quality of life. Boomers increasingly invest in their present needs, balancing immediate comforts with lasting family legacies, causing a reconsideration of how and when to distribute their assets to future generations.

12. Digital assets and nontraditional inheritances are becoming part of family wealth.

Digital assets and nontraditional inheritances are gaining recognition in family wealth planning. Crucial items like online businesses, digital currencies, and social media accounts add complexity to what constitutes an estate. Charging new terrain, they require thoughtful integration into traditional estate planning.

Presence in the digital world expands the definition of personal legacy, and detailed planning is key to seamless transitions. Addressing digital inheritance is crucial for ensuring that no asset, virtual or tangible, gets overlooked, reflecting the evolving landscape of modern family wealth management.