The quiet tricks scammers use to make smart seniors second-guess themselves.

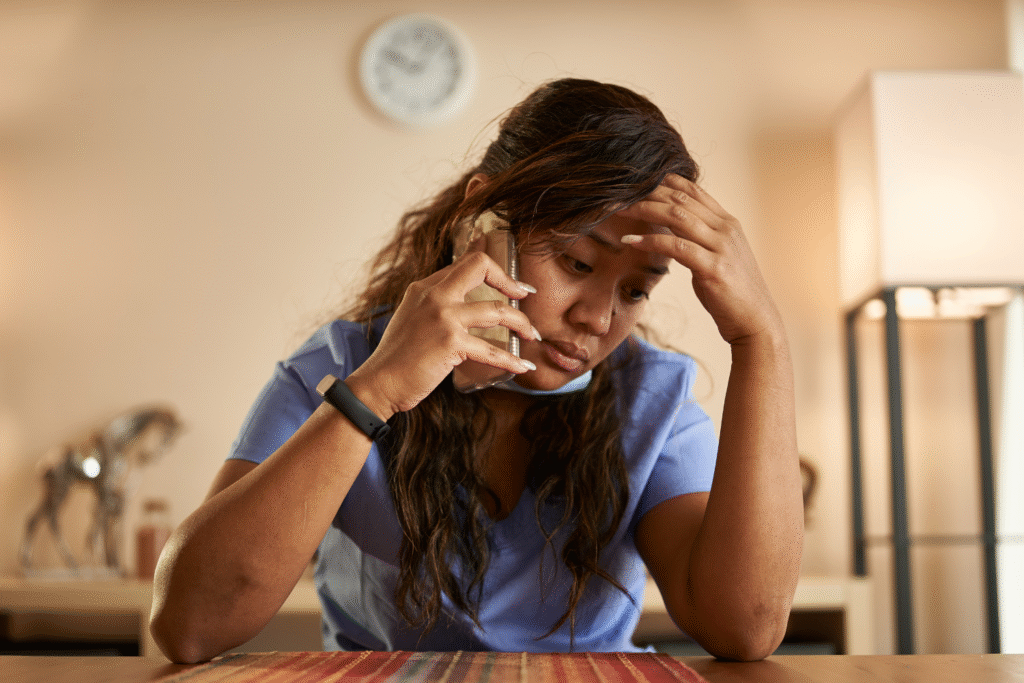

Staying calm is the hardest part when your screen screams “warning” and a fake technician promises to save the day. Tech support scams prey on urgency, politeness, and the fear of breaking something. I’ve seen careful people get tripped up because the script is that good.

Here’s a clean, simple playbook to spot the setup, shut it down, and help a friend do the same. Keep it handy, because the pitch changes, but the pressure always feels the same.

1. Fake pop-ups try to lock your screen and your attention.

A sudden red alert, loud beeping, and a message claiming your device is infected is a stage set, not a diagnosis. The goal is to startle you into calling a phone number planted in the pop-up. Real security tools never demand you call a random hotline to fix a crisis.

Close the browser tab or the entire browser. If it won’t respond, restart the computer. Afterward, clear the browser cache and history. Turn off and on the router for a fresh connection. If the pop-up returns on a known site, run a trusted antivirus scan you already use—never the one the pop-up advertises.

2. Unsolicited calls pretend to be helpful before they become urgent.

A smooth voice says they’re “monitoring errors” from your device or “partnering with your internet provider.” That sounds plausible enough to keep you on the line. The call pivots to urgency: your accounts are at risk, your warranty expired, or “strange logins” appeared overnight.

Hang up. Look up your provider or device maker on a bill or official site and call them yourself. If the caller resists or pressures you to stay, that’s your confirmation. Add the number to your phone’s block list, and tell one other person what happened. Saying it out loud helps break the spell and makes you less likely to be reeled back in later.

3. Remote-control requests are the moment the trap closes.

Scammers steer you to install remote access tools so they can “inspect the problem.” Once connected, they can plant files, fake errors, or browse saved passwords. The cursor moving on its own feels like magic; that sensation is used to build trust fast.

Refuse any request to install or run remote software unless you initiated support with a company you know, using a number you found independently. If you granted access, disconnect the internet immediately, uninstall the tool, and change your passwords from a different device. Then run a reputable malware scan and consider a professional cleanup from a local, well-reviewed shop you choose.

4. The refund-and-overpayment hustle turns confusion into cash.

You’re told a subscription was canceled and a refund is coming. “Accidentally,” they “send” too much money and show a fake bank page with a big deposit. Panic sets in, and they beg you to return the “extra” quickly to avoid them being fired.

Banks don’t ask customers to return mistaken refunds via gift cards, wire, or crypto. Sign out of your banking app, wait, and check again later on a separate device. If no legitimate deposit exists, you just dodged a setup. If money did move, talk to your bank directly using the number on your card and explain the situation before sending anything out.

5. Gift cards, wire transfers, or crypto are demanded because they’re untraceable.

When the “technician” insists the only way to secure your account is by buying gift cards or sending crypto, that’s the tell. They prefer payments that are hard to reverse and quick to cash out. The timer they set is a tactic, not a reality.

Adopt a personal rule: any request for gift cards, wire transfers, or crypto to fix a “tech issue” is an automatic no. If you already bought cards, keep the receipts and the cards, and contact the retailer right away to see if they can freeze funds. Then file a report and let family or friends know to watch for similar calls.

6. Phony renewal emails lean on brand names you recognize.

Messages claiming your antivirus, cloud storage, or printer plan is expiring are crafted to look routine. The links go to convincing clones that collect your card number or run “diagnostic downloads.” Familiar logos lower your guard just enough to click.

Don’t click. Instead, open a fresh browser tab and sign in to the real account the way you always do. If you don’t have that service, treat the email as junk. Mark it as spam, then delete it. For services you actually use, enable auto-renew inside your account so surprise invoices don’t push you into hasty decisions later.

7. Spoofed caller id makes impostors look legitimate.

Numbers can be faked to match your bank, a local shop, or even a relative. Seeing a known name on the screen is comforting—and that’s the point. The voice may ask for “verification” details or tell you to move money for “security.” It feels official because the display says so.

Trust procedures, not displays. Hang up, wait a minute, and call back using the number on your card or the company’s website. If a relative’s number shows up with a strange request, call them back. A real institution respects callbacks and clear paper trails; impostors push for speed and secrecy.

8. Pressure and secrecy signals mean it’s time to step away.

Scammers coach you to keep them on speaker and not tell anyone what’s happening. They warn that your accounts will be frozen or your data erased if you pause. The isolation is deliberate; a second opinion would unravel their story in seconds.

Make a habit of taking a break whenever money, access, or personal data is on the line. Say you need to grab a notebook, then hang up. Call a trusted person and describe the situation plainly. If the instruction can’t stand up to a five-minute timeout and a sanity check, it doesn’t deserve your money or your trust.

9. Simple device hygiene cuts off common exploits early.

Keeping your operating system, browser, and security tools updated closes holes scammers love. A modern browser blocks many malicious pop-ups and downloads by default. Using built-in password managers reduces the chance a fake site captures your login.

Turn on automatic updates and reboot weekly. Install one reputable security suite and let it run quietly; more isn’t better. Use unique passwords and add two-factor authentication, preferably with an authenticator app. Teach your browser to be suspicious by default: downloads only from sources you sought out, and extensions only from developers you actually recognize.

10. Money safety rules help when your nerves are frayed.

Create a “do-nothing rule” for financial scares: no transfers, no refunds, no gift cards until you’ve spoken to your bank using the number on your card. Consider a separate checking account for online purchases with limited funds to contain potential damage.

Turn on transaction alerts for charges, transfers, and logins. If something pings that you didn’t do, call the bank immediately. Freeze your credit if a scam involved personal details. Having these rules written near your computer helps you act on policy, not panic, when a slick voice tries to rush you.

11. If you were targeted, document it and report it right away.

Take screenshots of pop-ups, save emails, and write down phone numbers and instructions you were given. That record helps your bank understand the timeline and improves your odds of recovery. It also gives law enforcement patterns they can use.

Disconnect the device from the internet, change passwords on a clean device, and contact your bank and card issuers. Then file a report with the internet crime complaint center at ic3.gov and notify your local law enforcement. Share what happened with friends and family. Your quick report might save the next person a very expensive afternoon.