Practical items that boomers should sell now to save space, earn extra cash, and lighten their load before retirement.

Ready to embrace the freedom of retirement? Before stepping into this exciting new chapter, it’s time to declutter and prioritize what really matters. Many items in your home may no longer serve a purpose in this next phase of life. They may be taking up space you no longer want to maintain—or even contributing to a sense of stress or stagnation. Letting them go is a step toward a lighter, more intentional lifestyle.

Selling off unused belongings isn’t just about money—it’s about peace of mind. Extra income is always helpful, especially as you prepare for a fixed retirement budget. But just as important is the feeling of liberation that comes from clearing out the clutter. These changes can help set the stage for a simpler, more satisfying life. Here are 11 practical items boomers should sell now to lighten their load and gain a fresh start.

1. Downsizing furniture frees up space and creates a simpler lifestyle

Many boomers have furniture that suited a bigger, busier household—massive sectional sofas, china cabinets, or heavy wooden bedroom sets. But as the kids move out and retirement looms, those oversized pieces often become burdensome rather than useful. Selling them off not only clears up room but also helps shift your focus toward a more intentional way of living, as reported by Laura Sanchez at Aging Life Care Association. It’s a chance to redefine your home around your needs, rather than what once was.

By replacing them with versatile, comfortable furniture that fits a smaller space, you’ll create an environment that supports ease and movement. A cozy loveseat or a functional dining table for two might be all you need. The cash earned from selling your larger furniture could even go toward experiences—like travel or hobbies—that bring more joy and fewer headaches than hauling around that old armoire ever did.

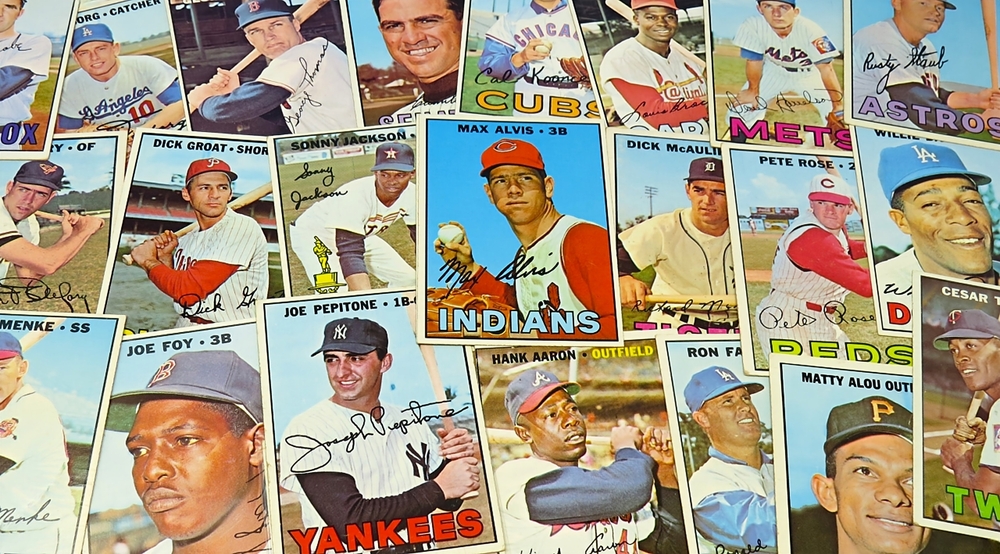

2. Selling collectibles puts extra cash in your pocket before you need it

Collectibles like vintage toys, sports memorabilia, or decorative plates may have been fun to accumulate, but they often end up gathering dust rather than appreciation. Many of these items have actual market value—especially if they’re rare or in good condition. It might be time to check if that old baseball card set or porcelain figurine collection is worth more than just sentiment, as mentioned by Nicole Anzia at The Washington Post.

Selling collectibles can give you a financial boost at a time when you’re preparing for a shift in income. Instead of leaving those items to heirs who might not want them, you can turn them into cash for things you value now—like travel, wellness, or simply boosting your emergency fund. Plus, lightening your shelves and display cabinets creates a sense of breathing room in your home.

3. Offloading recreational vehicles cuts unnecessary costs and opens up options

Campers, ATVs, and boats offer plenty of adventure—but they also come with ongoing expenses and logistical hassles. If you’re no longer using them regularly, those maintenance fees, insurance premiums, and storage costs can become a drain. Selling them off is a practical move, especially if your retirement vision involves simpler, more spontaneous travel.

The money you gain from selling recreational vehicles can be redirected toward experiences that don’t require hauling or upkeep—like train trips, cruises, or boutique hotel stays. This shift opens up more flexibility and can reduce the stress of ownership. Rather than having a driveway full of seldom-used toys, you’ll have a bank account ready for new adventures, according to Don Turrobia at Your Life Choices.

4. Selling old electronics eliminates clutter and generates quick income

Old laptops, smartphones, DVD players, and even vintage stereo systems often get shoved into closets, never to be used again. These items not only clutter your space but lose value over time. Selling them now while they’re still functional and desirable is a smart way to clear out tech clutter and get a little extra money in your pocket.

Online platforms and local buy-sell groups make it easy to offload electronics to buyers who will actually use them. This helps reduce e-waste while simplifying your environment. Plus, by letting go of outdated tech, you make room for modern, streamlined devices that are easier to maintain and more aligned with a relaxed retirement lifestyle.

5. Letting go of formal clothing saves closet space for what you’ll actually wear

Years of professional work often leave closets packed with business attire, suits, dresses, and accessories that rarely see the light of day anymore. If you’re stepping away from the formal office environment, there’s little need to hold onto these items. Selling them through consignment shops or online markets can help you recoup some of the investment you made over the years.

Clearing out formalwear makes room for a wardrobe focused on comfort and practicality—think breathable fabrics, casual wear, and pieces that move with you. You’re entering a chapter where ease and enjoyment take priority, and there’s no reason to let a crowded closet tie you to the past. Let someone else enjoy those beautiful clothes while you enjoy the space and simplicity.

6. Getting rid of books and media creates space for digital alternatives

Books, DVDs, CDs, and even vinyl records can take up an impressive amount of room. While they may hold cherished memories, they aren’t always practical—especially if you’re downsizing or hoping for a more minimalist lifestyle. Consider selling or donating most of your collection, especially titles you haven’t touched in years.

Thanks to e-books and streaming services, entertainment no longer needs to fill shelves. Embracing digital options makes it easier to move, clean, and reorganize. And for collectors, selling valuable or rare items can bring in extra cash. You’ll still have access to stories and music, but without the clutter that once came with them.

7. Unloading unused exercise equipment keeps your home clutter-free and functional

That treadmill in the corner or the dusty elliptical in the garage might have started out with good intentions—but if it’s been sitting unused for months (or years), it’s probably time to let it go. Exercise equipment takes up a lot of space, is difficult to move, and may not match your current fitness preferences.

By selling these bulky machines, you can reclaim space and simplify your home environment. The money you earn can fund alternative ways to stay active—like joining a local walking group, taking yoga classes, or swimming at a nearby pool. Retirement is about enjoying movement, not being surrounded by fitness reminders that no longer serve you.

8. Liquidating holiday decor reduces stress and makes downsizing simpler

Many boomers have amassed an impressive amount of holiday decorations—entire bins for every season and style. But managing all that décor becomes harder with age, especially if you’re moving into a smaller space. Selling or donating the excess allows you to keep only the most meaningful pieces.

Simplifying your holiday traditions can bring a surprising amount of peace. Decorating becomes easier and less exhausting, and you’ll feel less pressure to keep up elaborate displays. The bonus is freeing up storage space while earning a little extra for holiday travel, events, or gifts that mean more than a room full of tinsel.

9. Selling rarely used kitchen gadgets makes your home more practical

Kitchens often become graveyards for unused gadgets—panini presses, juicers, fondue pots, or rice cookers that haven’t seen daylight in years. If you’ve collected a kitchen full of appliances but only use a few, it’s time to declutter. Selling them gives you more breathing room and reduces decision fatigue when cooking.

As you plan for a simpler retirement lifestyle, focus on tools that align with how you actually eat and live. Freeing up cabinet space makes daily cooking more enjoyable and less chaotic. Plus, the proceeds from selling these items could fund a fun dinner out or a cooking class to explore new flavors in a fresh, hands-on way.

10. Getting rid of old cars cuts maintenance costs and boosts savings

If you’ve got a second or third vehicle that rarely gets used, now is the time to sell it. Cars are expensive to maintain—between insurance, registration, repairs, and depreciation, the costs add up fast. Keeping an extra car “just in case” may no longer be worth the expense or hassle.

Selling your unused car puts a meaningful chunk of money back in your pocket and reduces your overall responsibilities. Consider whether one reliable vehicle is enough or if retirement might be the perfect time to explore ridesharing, biking, or public transport. Simplifying your transportation can free up both time and money for better things.

11. Offloading duplicate or unused tools simplifies home projects

Years of homeownership often lead to toolboxes full of duplicate wrenches, old power tools, or specialty items you only used once. As you head into retirement, it makes sense to streamline your collection to just what you’ll realistically use for smaller tasks. Selling extra tools can generate unexpected cash and save precious space.

A simpler tool setup is easier to organize and more satisfying to use. Whether you’re taking on casual DIY projects or just want to be prepared for small repairs, you’ll enjoy having only what you need. Less clutter in your garage or shed means more room for creative pursuits, hobbies, or even that dream workshop you finally have time to build.