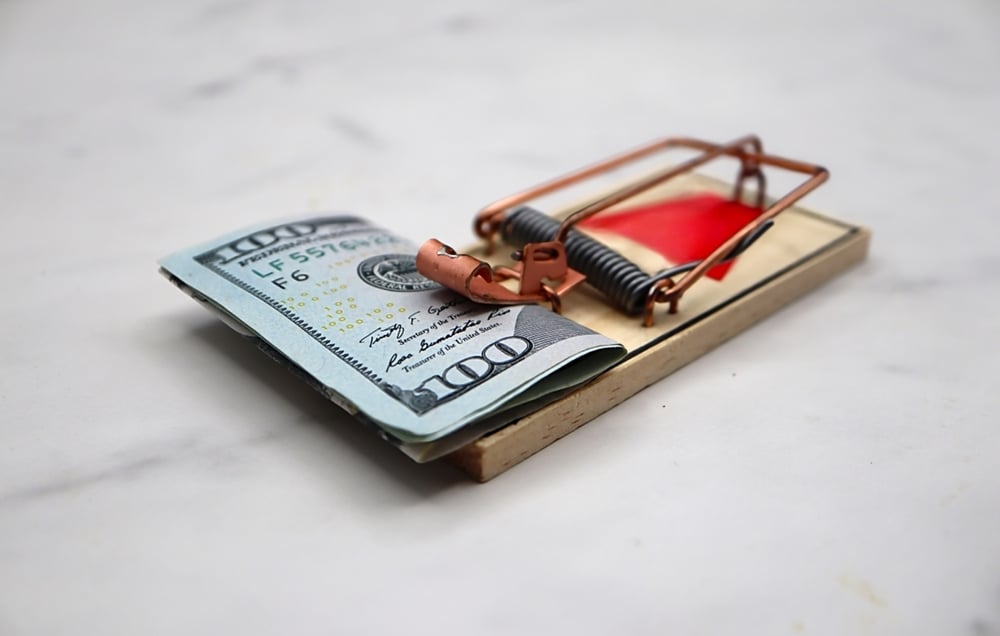

Smart money moves that keep seniors financially secure.

Frugality isn’t just about pinching pennies—it’s about making wise financial decisions that ensure long-term security. Many seniors have spent decades honing their money-saving skills, and they know exactly which financial traps to sidestep. Whether it’s avoiding overpriced services or resisting impulse buys, smart retirees know how to stretch every dollar.

Here are some common spending traps that financially savvy seniors steer clear of.

1. Buying extended warranties that aren’t worth it.

Many stores pressure customers into purchasing extended warranties on everything from appliances to electronics. While they sound like a good idea, they often cost more than they save. Many warranties have fine-print exclusions that make them nearly useless when the time comes to make a claim.

Smart seniors recognize that most products either fail within the standard warranty period or last long enough that an extended warranty isn’t necessary. Instead of wasting money on unnecessary coverage, they put those funds toward more critical expenses, according to Nasdaq.

2. Falling for “limited-time” sales tactics.

Retailers love to create a sense of urgency, using phrases like “limited-time offer” or “final clearance” to push customers into making impulse purchases. Frugal seniors know better than to fall for these high-pressure tactics.

They understand that most “exclusive deals” come around again and that taking the time to compare prices is always a better approach. By resisting the temptation to buy on impulse, they avoid wasting money on items they don’t truly need, according to Simplicity Habit.

3. Overpaying for brand-name medications.

Prescription drugs can be a major expense, but savvy seniors know that generic medications offer the same benefits at a fraction of the price. Many people assume that brand-name drugs are superior, but in reality, the FDA regulates generics to ensure they work just as effectively, according to Medical News Today.

Instead of blindly paying more for a recognizable brand, frugal seniors ask their doctors or pharmacists about lower-cost alternatives. This small habit saves them hundreds—or even thousands—of dollars over time without compromising their health.

4. Paying unnecessary banking fees.

Many banks charge monthly maintenance fees, ATM withdrawal fees, or overdraft fees that can slowly eat away at retirement savings. Frugal seniors avoid this by choosing fee-free checking accounts, setting up direct deposit, or maintaining minimum balance requirements to waive fees.

Online banks and credit unions often offer better terms than traditional banks. Seniors who shop around for the best financial institutions can avoid these hidden charges and keep more of their money where it belongs.

5. Falling into the luxury car trap.

Some retirees feel the urge to reward themselves with a luxury vehicle, but financially savvy seniors know that high-end cars come with excessive costs, including premium insurance, maintenance, and repairs. Instead of splurging, they opt for reliable, fuel-efficient vehicles with lower ownership costs.

Driving a moderately priced car instead of a luxury model can save thousands over time, allowing retirees to allocate those funds toward more meaningful experiences or future financial security.

6. Buying too much house in retirement.

While downsizing can be a smart financial move, some retirees end up purchasing a new home that’s still too large or expensive for their needs. Property taxes, maintenance, and utilities for a bigger home can quickly become a budget strain.

Frugal seniors think long-term before making housing decisions, choosing homes that are affordable, energy-efficient, and easy to maintain. This prevents unnecessary financial stress later on.

7. Ignoring senior discounts.

Many businesses offer discounts for seniors, but some people hesitate to ask or assume the savings aren’t significant. However, even small savings on groceries, entertainment, and travel can add up over time.

Frugal seniors make it a habit to ask about senior discounts wherever they go. Taking advantage of these small perks helps stretch their retirement budget without sacrificing quality of life.

8. Letting unused memberships go to waste.

Gym memberships, warehouse club subscriptions, and magazine deliveries often continue to charge retirees long after they’ve stopped using them. These automatic deductions may seem minor, but over a year, they can add up to hundreds of wasted dollars.

Financially wise seniors routinely review their subscriptions and cancel anything they don’t actively use. This simple habit ensures that no money is wasted on forgotten memberships.

9. Shopping without a plan.

Impulse buying is one of the easiest ways to waste money. Retirees who shop without a list often end up purchasing items they don’t need, leading to excess spending.

Smart seniors plan their purchases in advance, use coupons, and compare prices before heading to the store. By being intentional with their spending, they ensure their money is used wisely.

10. Not budgeting for home repairs.

Owning a home comes with inevitable maintenance costs, yet many retirees fail to set aside money for unexpected repairs. A sudden plumbing issue or roof leak can throw off a fixed-income budget if there’s no emergency fund in place.

Frugal seniors anticipate these costs by maintaining a home repair savings account. By preparing for these expenses in advance, they avoid financial strain when repairs become necessary.

11. Buying things just because they’re “on sale.”

Sales and discounts can be enticing, but frugal seniors understand that a bargain is only valuable if they actually need the item. Too often, people buy things they don’t need simply because they’re marked down.

Seniors who practice smart spending ask themselves whether a purchase is truly necessary before checking out. This prevents their homes from filling up with unused items and keeps their budget on track.

12. Lending money they can’t afford to lose.

Retirees with generous hearts sometimes feel obligated to financially help family members, but doing so can quickly drain their savings. Whether it’s co-signing a loan or giving repeated handouts, these well-intentioned gestures can backfire.

Frugal seniors set clear financial boundaries. They only give what they can afford to lose and prioritize their own long-term security over emotional pressure from loved ones.